Engineering Veneer is a thin sheet of wood, rotary cut, sliced or sawed from expensive natural wood. The Veneer is easy to be edge jointed and overlaid on Plywood , MDF , particleboard and so on. So, it can be used in fancy plywood, fancy MDF, fancy Blockboard and veneer faced Particle board.We have Natural Engineering Veneer and Engineering Fancy Veneer

Luli Group Co., Ltd, also supply engineered wood veneers with good quality and competitive pricing.

Advantages of using veneers:

Compared to wood, one of the primary advantages of using veneer is stability. While solid wood can be prone to warping and splitting, because veneer is made of thin layers of wood glued together, the chances of splitting or cracking are reduced. Further, the glue used provides additional strength, making the end result stronger than natural wood.

Usages of Veneer:

Used to cover the surface of plywood, MDF, chipboard, blockboard and so on.

Specification details:

Sizes: 1220mm x 2440mm, 1250mm x 2500mm or as your request

Thickness: From 0.15mm to 0.6mm or as per request

Species: Okoume, Bintangor, Terminalia, Red hardwood, etc.

Grade available: A/A, A/B, B/B

Cutting way: Rotary cutting

Engineering Veneer Engineering Veneer,Natural Engineering Veneer,Engineering Fancy Veneer,Engineered Wood Veneer Luli Group Co.,Ltd. , https://www.cnluli.com

Following the release of the most positive signal for the reform of the camp during the two sessions of the National People's Congress, on March 18, the executive meeting of the State Council deployed a comprehensive pilot program for the reform of the camp. This year, it is expected to reduce the corporate tax burden by more than 500 billion yuan. On March 20, Finance Minister Lou Jiwei said at the China Development Forum that the finance and taxation departments are working closely together to develop and expand the documents, and will fully communicate with taxpayers to ensure implementation on May 1. At present, the migration of tax information, basic information and archives has begun.

The "First Financial Daily" reporter learned from informed sources that the policy documents and supporting operation methods for the reform of the camp are expected to be announced this week. The program documents have more than 100 pages.

The head of the Department of Taxation and Finance of the Ministry of Finance recently asked the reporter about the reform of the camp to increase the 11% VAT rate for the construction industry and the real estate industry, and the 6% VAT rate for the financial industry and the life service industry. This is in line with previous market expectations.

In order to ensure that the tax burden of all industries is only reduced, taking into account reform and steady growth, this year's policy document on the reform of the camp will provide a “big moveâ€, that is, all VAT taxpayers can deduct the VAT included in the newly added real estate.

The above-mentioned insiders said that the new real estate deduction may be divided into two years, which will further increase the scale and intensity of tax reform and reduction, and promote the expansion of effective investment.

At the same time, the above-mentioned State Council executive meeting proposed that the original business tax preferential policies for new pilot industries should continue in principle, adopting transitional measures for specific industries, and implementing zero-tax or tax-free policies for service exports to ensure that tax burdens of all industries are only reduced.

Experts interviewed by this newspaper believe that as an important measure to deepen the reform of the fiscal and taxation system and the structural reform of the supply side, the comprehensive promotion of the reform of the camp will basically eliminate the double taxation, further reduce the corporate tax burden, and open the value-added tax. The deduction of the chain and the inclusion of real estate in the deduction range also mean that China has fully realized the consumption-based VAT system, which is of great significance.

New real estate included in the deduction

This year's government work report proposes to fully implement the reform of the camp. From May 1st, the scope of the pilot will be extended to the construction industry, real estate industry, financial industry, and life service industry, and the value-added tax included in the newly added real estate of all enterprises will be included. The scope of deductions ensures that the tax burden of all industries is only reduced.

The newly added four major industries have nearly 10 million pilot taxpayers, involving a business tax scale of 1.9 trillion yuan. Since the newly added real estate was included in the deduction for the first time, all new real estates were purchased through outsourcing, renting, and self-construction. Businesses will benefit from this. The implementation plan for the reform of the camp has attracted much attention, and the deduction of real estate has become the focus of the market.

Zhang Bin, director of the Tax Research Office of the Institute of Finance and Economics of the Chinese Academy of Social Sciences, gave an example to this reporter. If a company purchases an office building worth 100 million yuan, the deductible input tax is 11 million yuan. Deduction, the company may not need to pay VAT this year, but if it is deducted in 10 years, the annual input tax deductible is 1.1 million yuan. In the end, the specific deduction period will also need to wait for the implementation of the reform plan.

Zhang Lianqi, a member of the National Committee of the Chinese People's Political Consultative Conference, told the reporter of China Business News that the newly added real estate was included in the deduction range. It was implemented after the last round of VAT reform and reform in the northeast, which included the purchase of machinery and equipment into the deductible scope. The inclusive measures of the new promotion tax deduction, because this includes not only the tax reformers of the camp reform, but also the original VAT taxpayers such as manufacturing and commerce.

He said that allowing real estate deductions is not only large, wide, and high, accounting for about 60% of the total deduction, but also released a clear signal to encourage investment, which sounded a win to "three to one and one to make up" The fiscal and taxation horns (to de-capacity, destocking, deleveraging, cost reduction, and short-boarding) are also a key step in China's modern VAT system.

The "First Financial Daily" reporter learned from the above-mentioned insiders that the future new real estate deduction may be divided into two years, the first year deducted 60%, the second year deducted 40%. In the previous plan of the reform of the camp, the new real estate deduction was divided into 10 years, but in order to increase the tax reduction and support the development of the enterprise, the deduction period was shortened to 2 years.

According to the Ministry of Finance, as of the end of 2015, there were 5.92 million taxpayers in the national camp reform, including 1.13 million general taxpayers and 4.79 million small-scale taxpayers; the cumulative tax reduction was 641.2 billion yuan, of which pilot taxpayers Due to the tax conversion and tax reduction of 313.3 billion yuan, the original value-added taxpayer increased the tax deduction by 327.9 billion yuan.

Our reporter learned that last year's camp reform increased the annual tax reduction by about 240 billion to 250 billion yuan, and the above-mentioned State Council executive meeting said that it is expected that the scale of tax reduction and reduction will exceed 500 billion yuan this year. It is twice as strong as last year.

Tax rate finalized

For the upcoming implementation of the camp reform, the VAT rate is a major concern.

The head of the Ministry of Finance and Taxation said that the value-added tax rate for real estate and construction industry is 11%, and the value-added tax rate for financial and life services is 6%. Previously, the business tax rate for real estate, finance, and services was 5%, and the construction tax rate for construction was 3%.

Zhang Bin told the "First Financial Daily" reporter that under the principle of degenerate tax rate, it is not appropriate to set new tax rates for the four major industries. On this basis, it is necessary to consider that enterprises do not increase the tax burden, and then determine the four major industry tax rates.

At present, the general taxpayer's VAT rate in China is 17%, 13%, 11% and 6%, of which the standard rate is 17%. After comprehensive consideration, the final official chose a lower tax rate of 6% and 11%.

Li Jun, PwC China's central district turnover tax business partner, told this reporter that the value-added tax rate for food service, hotel and other life service industries and financial industry is close to the previous business tax, the tax burden is stable, and the real estate and construction industry adopts. The 11% VAT rate is also measured by many factors. From the industry response and calculation results, 11% is a more appropriate tax rate.

The VAT rate is for general taxpayers and for small-scale taxpayers.

Zhang Bin told this reporter that small and medium-sized taxpayers in the four major industries are mainly concentrated in the life service industry, and the levy rate of 3% is applicable.

Li Jun told this reporter that for most small-scale taxpayers, if the levy rate is 3%, the tax burden will drop compared with the previous 5% business tax.

Business tax preferential policy continuation

The above-mentioned executive meeting of the State Council has clarified that the original business tax preferential policies for new pilot industries will continue in principle and adopt transitional measures for specific industries.

Zhang Bin told this reporter that the business tax concessions are retained in principle to ensure the stability of the tax burden in the pilot industry. If there is no such preferential treatment after the increase in the reform, the corporate tax burden may rise.

After the change of the second-hand housing trading camp that the people care about, the original business tax concessions will continue. Zhang Bin believes that the second-hand housing business tax preferential policy is likely to shift, that is, the previous second-hand housing holdings for more than two years are exempt from business tax. In the future, the second-hand housing holdings for more than two years will also be exempted from VAT and the tax burden will be stable.

The above-mentioned insiders told this reporter that the VAT policy for the transfer of second-hand housing before and after the full implementation of the camp reform on May 1 will be differentiated, but the overall tax burden will not increase. For the new house, the invoice issued by the developer is directly deducted as an input.

Li Jun told this reporter that the business tax preferential policy has continued to become the focus of attention in the industry. For example, for the financial industry, the industry is very concerned about the exemption of business tax from the interbank lending interest before the bank will continue to be exempt from VAT.

How to deal with new and old contracts is also a major focus of the pilot industry. The official government will clearly adopt transitional measures for old contracts, old projects and specific industries, which will help reduce the tax burden of related industries.

Li Jun said that the current classification of new and old contracts is still subject to specific policy implementation rules. For example, the real estate industry is currently paying attention. Is the new and old contract division based on the project establishment time, the time the enterprise obtains the land or the completion of the house to a certain extent? This all needs to wait for the implementation rules.

Lou Jiwei said at the above forum that the current reform of the camp is still called a pilot, because the original value-added tax and business tax system, business tax is levied on sales, but it must be repeated, and the manufacturing industry is implementing value-added tax, which has already caused Certain distortions, including corporate behavior and financial distortions. Therefore, a lot of transitional measures need to be taken in the reform, "so we also called the camp to reform and increase the comprehensive pilot."

He also said that on this basis, the VAT bill will be enacted and then submitted to the National People's Congress for formal approval, that is, according to the statutory principle of taxation, the business tax will be abolished by then.

Extended reading: After the camp reform is added to Taiwan, the house price is up or down. Are you clear?

On March 18, Premier Li Keqiang presided over the State Council executive meeting to implement the "Government Work Report" on the full implementation of the requirements for the reform of the camp, further reduce the burden on enterprises, and promote the transformation and upgrading of the economic structure. The meeting was deployed. From May 1st, the four industries of construction, real estate, finance, and life services will be included in the pilot camp. Among them, the construction industry and the real estate industry apply the 11% tax rate, and the financial industry and life service industry apply the 6% tax rate.

Relevant departments estimate that it is expected that the implementation of the reform of the camp this year will reduce the corporate tax burden by more than 500 billion yuan. Li Keqiang said that the central government's deficit rate has increased to 3% this year and the fiscal deficit has increased by 560 billion yuan. This money is mainly used to reduce taxes for enterprises.

Recently, Wang Jun, director of the State Administration of Taxation, also said that this “competition reform†involves the first time that natural persons pay VAT collection and management, such as individual second-hand housing transactions.

Then, what impact will the “camp reform†have on the sale of individual second-hand housing? Has the transaction tax increased or decreased?

What taxes do I have to pay for second-hand housing transactions now?

At present, various taxes and fees that need to be paid for second-hand housing transactions include business tax, personal income tax, land value-added tax, stamp duty, urban construction tax, education surtax, local surtax and deed tax.

Among them, the business tax (excluding additional tax) tax rate is 5%. The business tax is levied on the basis of the full sale price of the house, and the value-added tax is different. It is based on the difference between the selling price and the purchase price tax.

After the "reform of the camp", the tax on second-hand housing transactions is increased or decreased?

In this regard, Chain Home Network believes that the reform direction of the national battalion reform and the original intention is to reduce the tax burden, the overall tax on second-hand housing transactions is declining, will not increase.

The first category: buyers bought a set of 500,000 yuan of housing, the current price rose to 1 million yuan, this time the input tax is 50 / (1 + 11%) * 11% that is about 50,000 yuan, and the sale The tax amount is 100/(1+11%)*11%, which is about 100,000 yuan, and the value-added tax is 50,000 yuan. (VAT = output tax amount - input tax amount)

The second category: buyers bought a set of housing of 900,000 yuan, the current price rose to 1 million yuan, this time the input tax is 90 / (1 + 11%) * 11% that is about 90,000 yuan, and the sale The tax amount is 100/(1+11%)*11%, which is about 100,000 yuan, and the value-added tax is 10,000 yuan.

"With such a comparison, it can basically be seen that if the value of the house is large, it is necessary to pay more VAT tax, and if the value of the house is small, it can be paid less." Yan Yuejin said.

Hu Yijian, a professor at the School of Public Economics and Management at Shanghai University of Finance and Economics, believes that it is not necessary to assert that the tax burden on second-hand housing transactions must be raised.

Some analysts believe that for real estate licenses for more than five years, the increase in the camp is a bad news, because the original price is very low, the value-added part is very large, if the value-added tax is increased according to 11%, then the tax burden is very large, It is bound to lead to a sharp fall in house prices; after the reform of the camp, there is no need to consider whether to buy or sell second-hand houses for two years, because they are paid according to the value-added part, and the state is to encourage transactions and circulation.

The "price map" is like this, should the sale still be sold?

I have figured out the changes in the tax on the second-hand housing of the "reform of the camp". Do we have to understand the house in the hand, or is the favorite room recently up? the answer is……

House prices have risen again! But do you know how high the housing prices in these first-tier cities are? Do you know how much “low†housing prices in second-tier cities such as Chengdu, Changsha, Kunming and Dongguan are?

China House Price Map

If you have no idea about the above price data, look at the picture below:

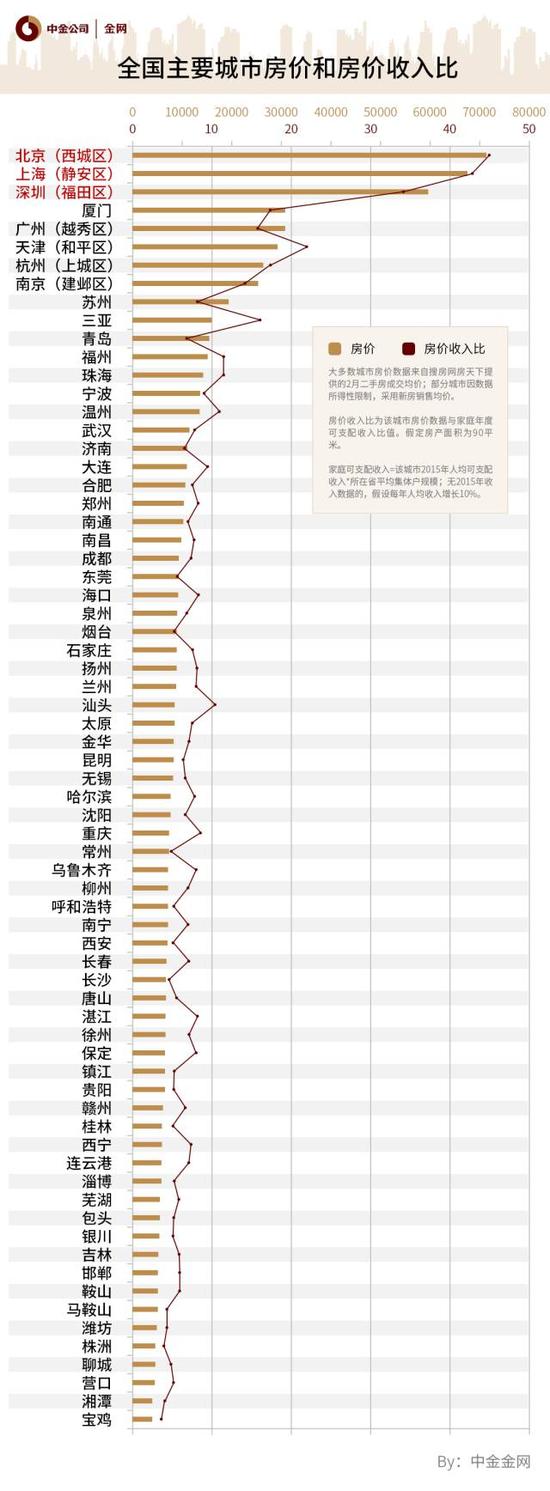

China's house price income ratio map

If the city's house price and house price income ratio are arranged, as follows:

The price and house price income of major cities in the country are higher than the price and house price income of major cities in China.

Unlike house prices, the per capita wages of cities in China are not much different, as follows:

If there is arbitrage in housing prices in Beijing and Chongqing, is Beijing housing prices too high or is housing prices too low?

If you make a scatter plot of house prices and wages in each city, as follows:

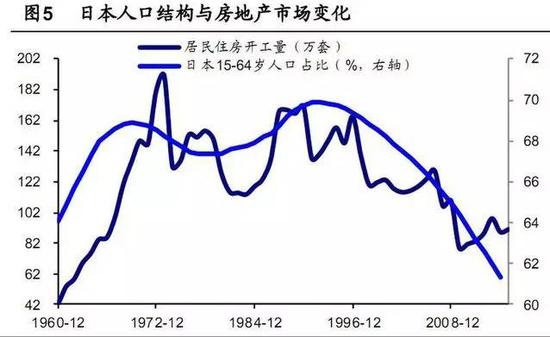

After the aging of the population, the economic slowdown is inevitable, because the burden is heavy, and the horizontal comparison of Japan and South Korea, these countries that successfully cross the middle-income trap, without exception, were young and leg-stricken at the time. So people jumped over as hard as they could. And we should not have this ability now. So on a national average, crossing the middle income trap is a big probability event.

Of course, it has to be said here, except for megacities, because megacities are actually using the Dafa method to absorb the strong labor force in the country. Take Shanghai as an example. The young population is still a lot. So many young people make Shanghai The economy has basically reached the level of developed countries, and people's income has also been short-listed. Of course, house prices are almost the same as New York, London, and Los Angeles.

In the past 10 years, the reason why the price of the first-tier cities has been rising is because of the incessant population inflow, increasing the number of millions of people in a year, coupled with the currency oversupply, so the price of first-tier cities has already entered the bubble. At the stage, compared with the prices of third- and fourth-tier cities, there is some embarrassment.

We can see that the comparison between house prices and population in Japan and the United States was a coincidence. After the aging of the population, there was an irreversible decline in house prices. Will this happen in the big cities of the first line? I believe that the simplest truth is that the house is for people. If you improve your needs, you should also sell the previous house to someone who is poorer than you. If you can't find someone who is poorer than you, pick you up. When you are in the house, all the chains that improve your needs will be interrupted.

If the population does not grow, or even negative growth, this demand will be reversed. With the aging of the aging, the permanent residents of the first-tier cities will release huge housing supply. Whether Beijing and Shanghai still lack houses is indeed a huge problem.

In other words, if you have a household, you have to have a house to call a family, so at least 5.89 million houses, plus other properties, the number of Beijing stocks in 2012 should be at least Up to 6 million sets. The completed area in 2015 is about 26 million square meters, which is about 300,000 sets.

In other words, in the three years from 2012 to 2015, Beijing has to add at least 1 million sets, enough for 3 million people to live. This is not the permanent resident who moved to Yanjiao, so how can it be enough? The decline in the future population will make the house scarce and the lie will not break.

The reform of the camp is expected to release a 500 billion tax cut this week.

Abstract The final battle of the business tax reform value-added tax (hereinafter referred to as “camp reformâ€) involving more than 10 million taxpayers is about to start. Following the release of the most positive signal of the reform of the camp during the two sessions of the National People's Congress, on March 18, the State Council executive meeting deployed a comprehensive push to open a pilot program for the reform of the camp. This year...

The final battle is about to start when the business tax is changed to more than 10 million taxpayers (hereinafter referred to as “camp reformâ€). After the "reform of the camp", the tax on second-hand housing transactions is increased or decreased?

Yan Yuejin, research director of the Yiju Research Center think tank, believes that under the background of “reform of the campâ€, it is to increase the burden or reduce the burden. In essence, it depends on the input tax amount. Can be explained from two different types of home purchase behavior: Rate map

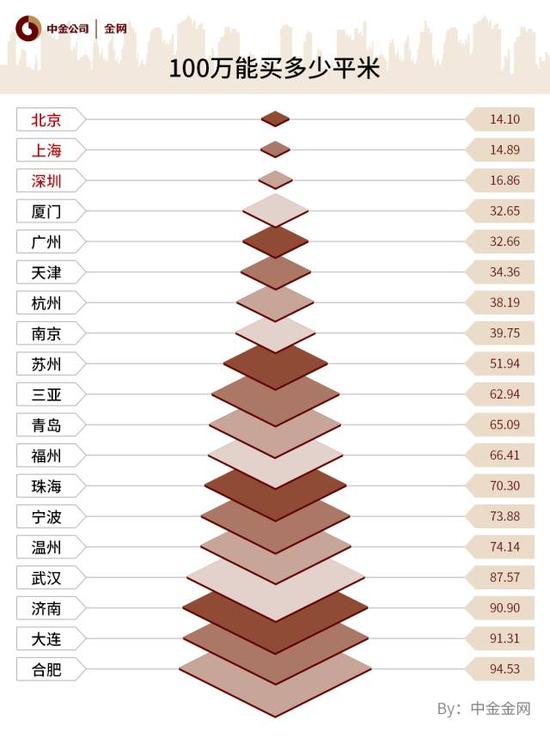

The “China House Price Map†includes the latest (February 2016) house price data for 70 major cities across the country. The CICC real estate experts track, collect and collate multiple sources (including SouFun, some real estate agents and other data sources). ) made. How much can I buy 1 million?

One million to 99.99% of Chinese people are not a small number, but for housing prices, especially in the north, the price is... House price income comparison chart

As you know, house prices are not determined by the average purchasing power of local residents. For the vast majority of individuals (or families) with only wage income, buying a home is a lifetime. wage

Among the 70 major cities, the average wage in 2014 (average wages of urban workers) was only 41,219 yuan, and the highest in Beijing (average wages of employees in the post) was 102,268 yuan per capita, 2.5 times less than the average. We must know that Beijing house prices (70,943 yuan / square meter) is 13.9 times that of 邯郸 (5,097 yuan / square meter). City house prices and wages

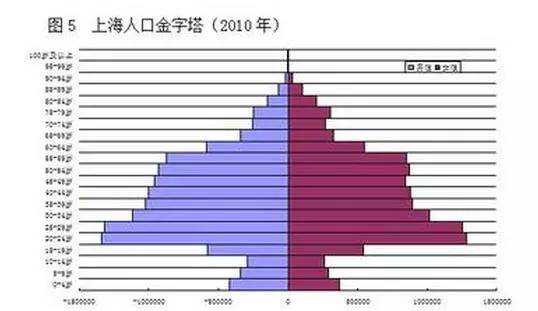

Economic growth, housing prices, income, and population omnipotence are clearly explained! Shanghai Population Pyramid

So now the problem is coming again. Although Shanghai is very young across the country, Shanghai is getting older and older than its own past, and under the guidance of policies that strictly control the population of megacities, Shanghai The population began to show a sharp turning point. At first, I thought it was hype. Later I got the data of water and electricity in Shanghai. It really is that the population is decreasing. At least the population is not flowing in. Like Shanghai, Beijing also The same problem has arisen. Japan's demographic structure and changes in the real estate market

At the end of the note, I often wondered how many houses in Beijing, this data is difficult to investigate, but it seems that there is no such data. I think there are some people who are afraid to disclose this truth, because in fact, they simply know that the house is oversupply. According to the population of Beijing 21 million in 2015, each person is 30 square meters, which is about 600 million square meters. According to a house of 90 square meters. Rough statistics, about 6 million sets will be enough. Finally, when the stepped electricity price plan was announced in Beijing in 2012, I accidentally leaked the secret: Beijing has a total of 589,360 “one household, one meter†resident users.